Irs Form W-4V Printable - Social Security Top 10 Benefit Questions Answered - AARP : The updates are mostly in the form of structural changes rather than how.

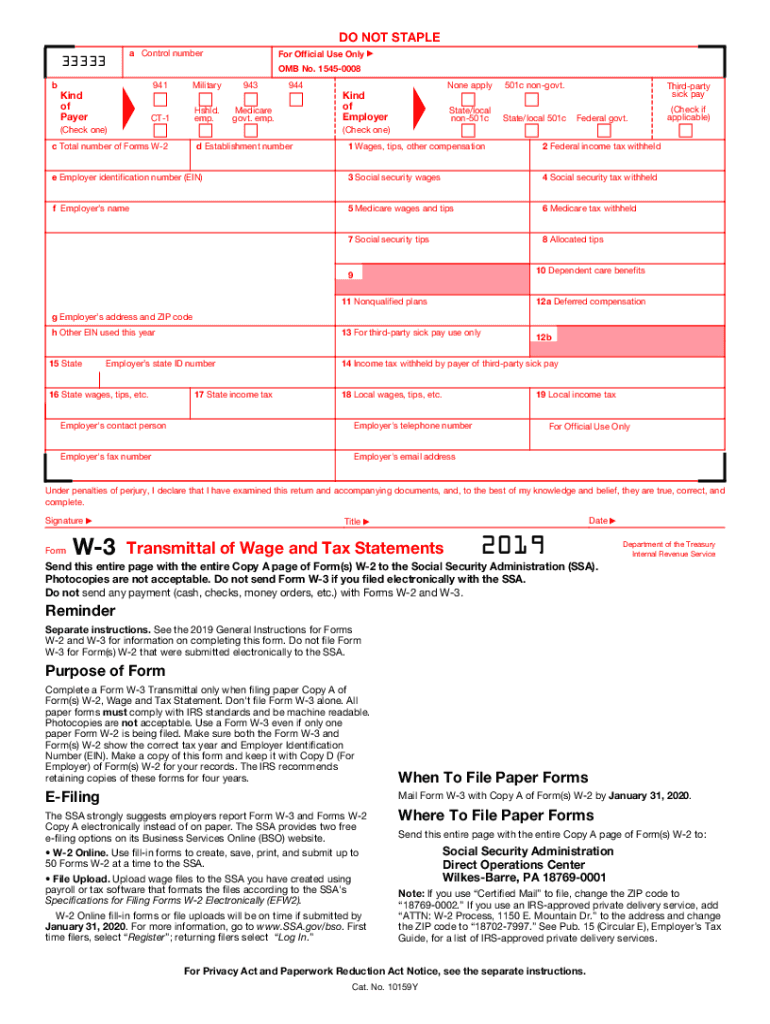

Irs Form W-4V Printable - Social Security Top 10 Benefit Questions Answered - AARP : The updates are mostly in the form of structural changes rather than how.. As a payer, you will require to submit a separate transmittal form 1096 for each type of 1099 tax forms you transmit. Irs form 1096 is a summary or transmittal return that shows the totals of all 1099s filed with the irs. Have to report certain financial information to the irs on regular basis. The pdf forms were downloaded from the. The document consists of worksheets intended for calculating the number of allowances to claim.

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Most individuals and individuals the u.s. The irs revamped the form for 2020 with the aim of making it easier to fill out. If you are an adp client, you will receive additional instructions on how your specific payroll and tax withholding systems will be modified to accept new inputs and handle revised. All the 1040 forms and instructions you need to complete your tax return are provided for you.

Save or instantly send your ready documents.

Irs form 1096 is a summary or transmittal return that shows the totals of all 1099s filed with the irs. This is the official irs form used by employees to declare their withholding exemptions from their paycheck. If you are an adp client, you will receive additional instructions on how your specific payroll and tax withholding systems will be modified to accept new inputs and handle revised. February 2018) department of the treasury internal revenue service. This document should be given to your employer once completed. Give this form to your payer. Available for pc, ios and android. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Save or instantly send your ready documents. It has only five steps. Collection of most popular forms in a given sphere. As a payer, you will require to submit a separate transmittal form 1096 for each type of 1099 tax forms you transmit. However, you may claim fewer (or zero) allowances.

Irs form 1096 is a summary or transmittal return that shows the totals of all 1099s filed with the irs. Most individuals and individuals the u.s. The document consists of worksheets intended for calculating the number of allowances to claim. It has only five steps. Complete all worksheets that apply.

For regular wages, withholding must be based on.

All the forms on the irs website is displayed as pdf so you can view, download, or print directly off of your browser. It is also necessary submit a new document any time their personal or financial situation changes. I am not familiar with that term.employees working in the u.s. The updates are mostly in the form of structural changes rather than how. The internal revenue service provides all of the tax forms that taxpayers need on the agency's website. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Start a free trial now to save yourself time and money! 2019 printable irs forms w 4. Have to report certain financial information to the irs on regular basis. Rules governing practice before irs. Available for pc, ios and android. The document consists of worksheets intended for calculating the number of allowances to claim. Do not send it to the irs.

Give this form to your payer. 2019 printable irs forms w 4. Did you know turbotax software is designed to take away the burden of understanding irs tax forms and instructions? All the forms on the irs website is displayed as pdf so you can view, download, or print directly off of your browser. (for unemployment compensation and certain federal government and other note.

(for unemployment compensation and certain federal government and other note.

We offer detailed instructions for the correct federal income tax withholdings 2019 w 4 form printable. Irs form 1096 is a summary or transmittal return that shows the totals of all 1099s filed with the irs. It has only five steps. The document consists of worksheets intended for calculating the number of allowances to claim. Payments is more convenient than making quarterly estimated tax. I am not familiar with that term.employees working in the u.s. Available for pc, ios and android. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Give this form to your payer. (for unemployment compensation and certain federal government and other note. If you are an adp client, you will receive additional instructions on how your specific payroll and tax withholding systems will be modified to accept new inputs and handle revised. As a payer, you will require to submit a separate transmittal form 1096 for each type of 1099 tax forms you transmit. Have to report certain financial information to the irs on regular basis.

Komentar

Posting Komentar